Elta balance units are integral to the Elta ecosystem, representing ownership and participation rights within the network. These units signify a user's economic stake and can confer voting rights, event participation, and future rewards or dividends, scaled by the number of units held relative to the platform's total balance. Users must actively monitor their balance units to maintain an understanding of their system control proportions. The value and functionality of Elta balance units are dynamic, influenced by network activities and policies, making them a fluid asset with potential evolving benefits. Users need to grasp the issuance, transfer, and management processes of these units for effective utilization within the ecosystem. Newcomers should utilize available resources like interfaces and documentation to understand these units thoroughly. It's essential to recognize that Elta balance units operate under a robust legal framework designed to safeguard investors and maintain market integrity. This framework includes detailed legislation addressing issuance, transfer, and compliance requirements, ensuring transparency in financial reporting. Investors must review relevant legal documents and understand market dynamics, economic influences, and regulatory oversight before investing. A strategic investment approach, considering personal financial goals and risk tolerance, is critical for optimizing returns from Elta balance units. Regularly reviewing industry trends, regulatory shifts, and company announcements is imperative for informed decision-making. Diversification within Elta's portfolio across various market segments is key, as is aligning investment strategies with long-term goals. By utilizing comprehensive financial analyses and staying informed on the liquidity profile and redemption policies of Elta balance units, investors can construct a resilient and diversified portfolio for sustainable wealth creation within the regulated environment of the Elta ecosystem.

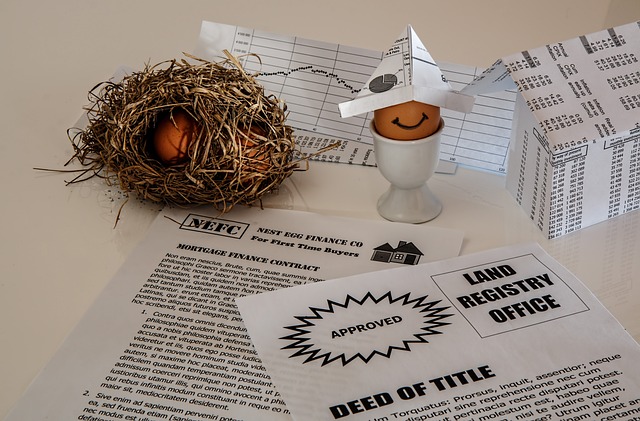

Elta balance units present a unique investment opportunity for those looking to diversify their financial portfolio. This comprehensive guide delves into the essential aspects of owning Elta balance units, from the basics to sophisticated trading strategies. We’ll explore the legal framework that supports this form of ownership and provide insights into the market dynamics of Elta balance units. Whether you’re new to investing or seeking to refine your approach, this article offers valuable advice for building and managing a portfolio with Elta balance units, ensuring informed decision-making in the dynamic financial landscape.

- Understanding Elta Balance Units: The Basics of Ownership

- The Legal Framework Governing Elta Balance Unit Ownership

- Financial Considerations and Investment Strategies for Elta Balance Units

- Navigating the Market: Valuation and Trading of Elta Balance Units

- Building a Portfolio with Elta Balance Units: Tips and Best Practices

Understanding Elta Balance Units: The Basics of Ownership

Understanding Elta balance units is fundamental for any owner or potential investor in the Elta ecosystem. These units represent a share of the total balance within the system and are an integral part of the platform’s operations. Ownership of Elta balance units grants holders access to various services and functions available on the network, which can include voting rights, participation in certain events, or even a claim to future rewards or dividends. It’s crucial for users to keep track of their balance units as they reflect the proportionate share of the platform’s overall balance that the user controls. The value and utility of these units are determined by the activities and policies within the Elta network, making them a dynamic asset whose benefits can evolve over time. As such, understanding how to manage, utilize, and interpret one’s balance units is key to maximizing the potential of one’s investment or involvement with Elta.

When delving into the specifics of Elta balance units, it’s important to grasp the mechanics of their issuance, transfer, and management. These units are minted in accordance with the platform’s rules and can be transferred between users as per their discretion or as part of a transaction on the network. The balance units serve as a reflection of one’s economic stake within Elta, influencing one’s standing and potential influence within the community. For newcomers, it’s advisable to familiarize oneself with the user interface, support resources, and official documentation provided by Elta to navigate these balance units effectively. A solid understanding of how these units function within the broader context of the platform will empower users to make informed decisions regarding their investment and engagement with Elta.

The Legal Framework Governing Elta Balance Unit Ownership

In the realm of financial investments, Elta balance units represent a distinctive category within the broader scope of investment products. These units are subject to a comprehensive legal framework designed to protect investors and maintain market integrity. The ownership of Elta balance units is governed by specific legislation that outlines the rights and responsibilities of both issuers and holders. This legislative framework includes regulations pertaining to the issuance, transfer, and redemption of these units, ensuring compliance with securities laws and regulations. Investors are encouraged to familiarize themselves with the relevant legal documents, including the prospectus and the terms and conditions associated with Elta balance units, which provide detailed information on the operational aspects and any limitations or risks involved. Additionally, the legal framework mandates transparency in financial reporting and disclosure, ensuring that investors have access to accurate and timely information necessary for informed decision-making. It is imperative for potential investors to understand this framework to navigate the purchase, management, and eventual disposal of Elta balance units effectively within the regulated environment. The regulatory body overseeing these units enforces compliance with the established rules and standards to safeguard investor interests and maintain market stability.

Financial Considerations and Investment Strategies for Elta Balance Units

When considering the acquisition of Elta Balance Units, it’s prudent to thoroughly evaluate the financial implications and develop a sound investment strategy. Prospective investors should examine their current financial situation, risk tolerance, and long-term objectives. The value and stability of Elta Balance Units can be influenced by factors such as market demand, economic conditions, and the company’s performance. Diversifying one’s portfolio with Elta Balance Units can offer a balance between risk and reward, especially for those looking to participate in the growth potential of the company within the real estate sector.

Investment strategies tailored for Elta Balance Units might include a mix of long-term holding for steady income generation and short-term trading to capitalize on market volatility. It’s crucial to stay informed about industry trends, regulatory changes, and any company announcements that could impact the value of these units. Additionally, understanding the liquidity of Elta Balance Units and their redemption policies will help investors manage their holdings effectively. By aligning investment decisions with personal financial goals and conducting due diligence on market conditions, investors can make informed choices regarding Elta Balance Units.

Navigating the Market: Valuation and Trading of Elta Balance Units

Building a Portfolio with Elta Balance Units: Tips and Best Practices

When considering the acquisition of Elta Balance Units, building a diversified portfolio is a strategic approach that can help mitigate risks and capitalize on various market opportunities. Investors should focus on understanding the fundamentals of Elta’s business model, including its revenue streams, financial health, and growth potential. A prudent investment strategy involves starting with a modest number of units and gradually increasing your position as you gain confidence in the company’s performance and market outlook. It’s advisable to allocate your investments across different sectors within Elta’s portfolio to spread risk; this includes considering both developed and emerging markets where Elta operates.

Another key consideration is the alignment of your investment goals with the long-term vision of Elta. Regularly reviewing your portfolio to ensure it reflects market changes and your evolving financial objectives is crucial. Diversification within Elta Balance Units can be achieved by investing in a mix of property types and balance unit classes that Elta offers. Keep abreast of market trends, regulatory changes, and economic indicators that may influence Elta’s performance. Engaging with Elta’s financial reports, investor presentations, and market analyses will provide valuable insights to inform your investment decisions. By adhering to these tips and best practices, you can construct a robust portfolio of Elta Balance Units tailored to your individual risk tolerance and investment horizon.

Elta balance units present a unique investment opportunity for those well-versed in their legal, financial, and market dynamics. This guide has elucidated the foundational aspects of ownership, the framework regulating these units, and the strategies to consider when investing in them. Understanding the valuation and trading mechanisms is crucial for navigating this market effectively, as is building a well-diversified portfolio with Elta balance units, which can be tailored to individual risk profiles and investment goals. As you consider this asset class, it’s advisable to stay informed on the latest developments in its regulatory environment and economic factors that influence its value. With careful analysis and strategic planning, Elta balance units can serve as a valuable component of a broader investment strategy.